Third quarter results 2019

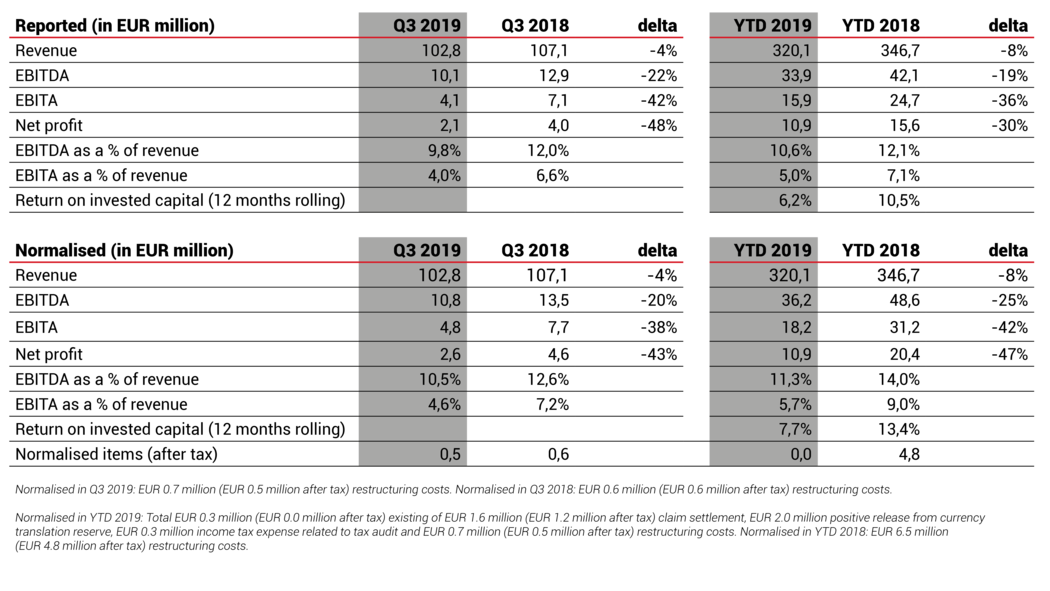

- Revenue of EUR 102.8 million in Q3 2019, down 4% compared with Q3 2018 (EUR 107.1 million)

- EBITDA (normalised) decreases by 20% to EUR 10.8 million in Q3 2019 (Q3 2018: EUR 13.5 million), with an EBITDA margin of 10.5%

- Net profit (normalised) of EUR 2.6 million in Q3 2019 (Q3 2018: EUR 4.6 million)

- China continues to grow with around 30% year-on-year

- Strong normalised free cash flow of EUR 7.8 million

- Further efficiency improvements with EUR 5.0 million expected annualised savings as from 2020

- Kendrion intends to acquire INTORQ GmbH & Co. KG, a global market leader in spring-applied brakes – as announced today in a separate press release

- Kendrion to cancel its currently ongoing share buyback programme as per today

Joep van Beurden, Kendrion CEO:

"In Q3 the weak market demand affected our revenue as trade tensions and their broader impact on consumer confidence continued. In Automotive, the market slowdown continues with decreasing vehicle sales across the globe. In the Industrial market, which was resilient in 2018 and the first months of 2019, we now see lower activity levels and destocking.

The revenue decline of 4% in both Automotive and Industrial has put our results under pressure, and we continue to adapt our organisation. We have decreased our staff costs with another 4% compared with the same period last year and have identified further areas for efficiency improvements of EUR 5.0 million on an annualised basis in 2020. Cash flow has been satisfactory at EUR 7.8 million.

Despite the difficult trading environment, we continue to invest in our focus areas of Automotive, industrial brakes and China, as we firmly believe in the longer-term prospects of our business. In Automotive, we added significantly to our project pipeline and we continue to win new projects in both China and Europe. Importantly we won the first commercial contract for our "battery cooling valve and control system", one of our six new "Lighthouse" platforms. China continues to be successful in terms of growth, with around 30% in the third quarter, up from 21% in H1 2019.

And today, we also announce a step change in brakes, with the intended acquisition of INTORQ GmbH & Co. KG, a global market leader in spring-applied brakes. With this acquisition we complement our leading position in permanent magnet brakes allowing us to offer a complete product range to customers in Europe, the U.S., China and India, in applications such as geared and servomotors, elevators, forklift trucks, wind power and robots. We expect the transaction to close in Q1 2020. I refer to our separate announcement issued today for more details.

We are gearing up for a tough Q4, and expect the current difficult trading environment to continue into 2020. As evidenced by the continued investment in our growth areas and the intended acquisition of INTORQ, we strongly believe in the opportunities for both our Automotive and Industrial activities, and reiterate our long-term financial targets."

Progress on strategy

Kendrion has built a robust and lean organisation with a strong financial position. We will maintain our focus on further improving operational effectiveness and containing cost levels. Over the third quarter, we realised a decrease in normalised staff costs of 4% to EUR 30.2 million (Q3 2018: EUR 31.6 million). We have incurred EUR 0.7 million in non-recurring restructuring costs in the third quarter to further reduce cost levels in all units. We expect to realise additional savings in staff costs of around EUR 5.0 million annualised savings as from 2020, with total corresponding one-off cost of EUR 3.0 million.

The number of employees (FTEs) at the end of the third quarter 2019 was 2,389, including 85 temporary employees (Q3 2018: 2,573 employees, including 128 temporary employees). In China our workforce numbers 189 employees up from 163 a year ago, to facilitate our substantial growth in the region.

We continue to invest in our three focus areas: Automotive, industrial brakes and China. In Automotive, we have introduced six "ACES" Lighthouse platforms to make use of the significant disruption in the market as vehicles become ever more Autonomous, Connected, Electric and Shared. We won our first commercial project for a "battery cooling valve and control system", which will help to increase the driving distance of electric vehicles. Although vehicle sales are down in China, both our revenue and our pipeline continue to grow. We invest significantly in production lines, our local supply chain, and manpower to build and train our Chinese team.

In brakes, our intended acquisition of INTORQ is expected to strengthen our position in this important growth market in Europe, the U.S., China and India. Reference is made to the separate press release issued today.

Financial review

Revenue

Third quarter of 2019

Revenue in the third quarter came in at EUR 102.8 million, a decrease of 4% (5% at constant exchange rates), which was equally spread over Automotive and Industrial, each showing a 4% decline against Q3 last year. Following a decline of 12% in the first half of the year, the pace of decline in Automotive activities slowed down somewhat, as the year-on-year comparables eased. Global trade tensions, uncertainly surrounding Brexit and the broader impact on confidence and spending by consumers are impacting vehicle sales worldwide. In Industrial, the economic slowdown is felt with lower economic activity combined with destocking.

First nine months of 2019

Compared with the first nine months of 2018, revenue decreased by 8% (8% at constant exchange rates), with the Automotive activities declining by 10% (11% at constant exchange rates) and Industrial activities by 4% (4% at constant exchange rates).

Results

Third quarter of 2019

The normalised operating result before amortisation (EBITA) fell by 38% to EUR 4.8 million (Q3 2018: EUR 7.7 million). Profitability declined both in Automotive and Industrial, on the back of the decrease in revenues and a reduction of finished inventory. The sharp reduction in inventory had a positive effect on cash flow, but a negative impact on income, with less production costs absorbed. The third quarter of 2018 saw the opposite effect. The impact of both lower revenues and lower production of finished inventory could only partly be offset by EUR 1.4 million (4%) lower staff costs. As a result, the normalised EBITA margin decreased from 7.2% to 4.6%.

First nine months of 2019

Normalised EBITA in the first nine months of 2019 decreased to EUR 18.2 million (first nine months of 2018: EUR 31.2 million). The normalised EBITA margin decreased from 9.0% in the first nine months of 2018 to 5.7% in year-to-date 2019.

Normalised net finance costs in the first nine months of 2019 amounted to EUR 1.9 million (first nine months of 2018: EUR 2.3 million) due to improved financing conditions following the refinancing in July 2018.

Normalised income tax expenses for the first nine months of 2019 were EUR 3.8 million, significantly below the EUR 6.6 million over 2018, reflecting the lower net profit. The normalised effective tax rate in the first nine months of 2019 was 25.8% (2018: 24.4%).

Normalised net profit for the first nine months of 2019 was EUR 10.9 million, down from EUR 20.4 million in the first nine months of 2018. Normalised net earnings per share decreased to EUR 0.82 (first nine months of 2018: EUR 1.53).

Financial position

The net debt position at the end of the third quarter was EUR 94.4 million. This represents a decrease of EUR 1.8 million compared with the second quarter and is the result of EUR 6.2 million reported free cash flow, EUR 3.6 million repurchased shares and a EUR 0.8 million increase in IFRS 16 lease liabilities. Kendrion's financial position remains strong, with a solvency ratio of 47.3%.

Free cash flow in the first nine months of 2019 was EUR 2.5 million (first nine months of 2018: EUR 4.4 million), with a strong cash flow generation in the third quarter. Kendrion continues to reduce working capital levels, which will remain a focus point for the fourth quarter as well.

Capital expenditure totaled EUR 15.2 million in the first nine months of 2019 (first nine months 2018: EUR 20.7 million), below the depreciation level of EUR 18.0 million. Investments for the full year 2019 are anticipated to be slightly below the depreciation level because of strict capex control with respect to non-project related investments.

Outlook

The outlook for the global economy remains weak, impacting both the automotive and industrial businesses. We currently see no signs of an improvement and expect the weakness to continue in Q4 and further into 2020.

We continue to rigorously tackle costs while at the same time investing in our long-term growth opportunities. In the coming months, we will focus on cash flow and the reduction of working capital. Capex will be largely limited to project related investments in our focus areas of Automotive, industrial brakes and China. We see ample growth opportunities in these areas in the medium to longer term and remain positive about our business fundamentals. with our main objective being to deliver sustainable profitable growth. We reiterate our medium-term targets of ROIC of at least 20% and an EBITDA margin of more than 15% by 2023.

Share buyback programme cancelled

Kendrion will cancel its currently ongoing share buyback programme of 625,000 shares (as announced on 13 August 2019) as per today. Up to 4 November 2019, 235,592 shares have been repurchased for a total amount of EUR 4.2 million. Repurchased shares will not be cancelled.

Audio webcast Q3 2019 results

Kendrion CEO Joep van Beurden and CFO Jeroen Hemmen will present the Q3 2019 results and intended acquisition of INTORQ GmbH & Co. KG per Q1 2020 on Tuesday, 5 November 2019 at 11.00 a.m. at the Mövenpick Hotel Amsterdam City Centre, Piet Heinkade 11, 1019 BR Amsterdam. A live audio webcast will be available on www.kendrion.com with playback functionalities.

Profile of Kendrion N.V.

Kendrion develops, manufactures and markets high-quality electromagnetic systems and components for industrial and automotive applications. For over a century, we have been engineering precision parts for the world's leading innovators in passenger cars, commercial vehicles and industrial applications. As a leading technology pioneer, Kendrion invents, designs and manufactures complex components and customised systems as well as local solutions on demand.

We are committed to the engineering challenges of tomorrow, and taking responsibility for how we source, manufacture and conduct business is embedded into our culture of innovation. Rooted in Germany, headquartered in the Netherlands and listed on the Amsterdam stock exchange, Kendrion's expertise extends across Europe, to the Americas and Asia. Created with passion and engineered with precision.

Amsterdam, 5 November 2019

The Executive Board

For more information, please contact:

Kendrion N.V.

Mr. Joep van Beurden

Chief Executive Officer

Tel: +31 85 073 1504

Email: IR@kendrion.com

Website: www.kendrion.com

Annexes

1. Consolidated statement of comprehensive income

2. Consolidated statement of financial position

3. Financial calendar 2020

Press release: THIRD QUARTER RESULTS 2019