Half year results 2019

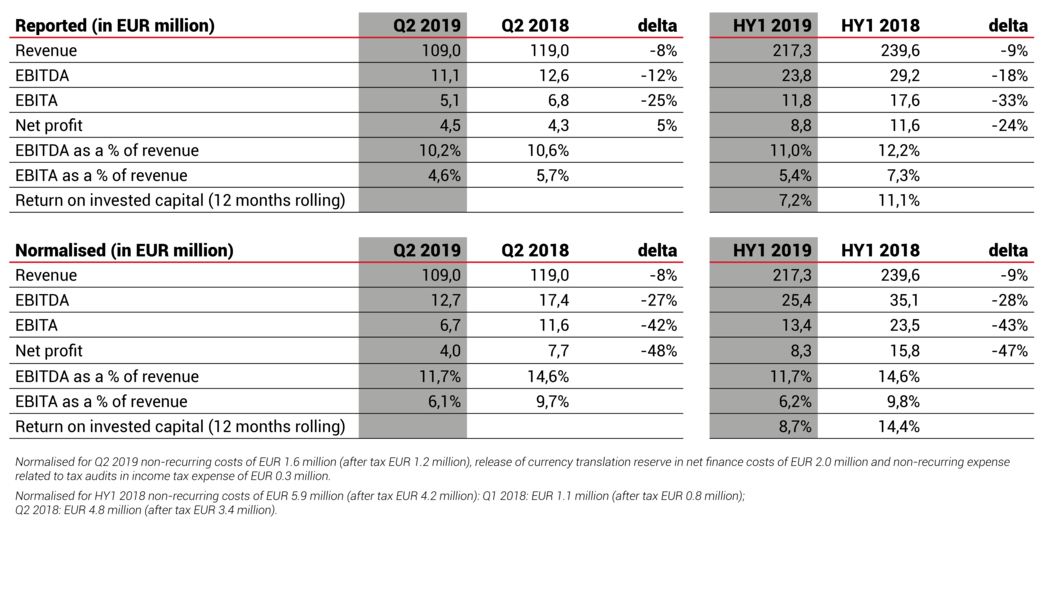

- Revenue decreases in Q2 2019 by 8% to EUR 109.0 million (Q2 2018: EUR 119.0 million)

- Normalised EBITDA in Q2 2019 decreases 27% to EUR 12.7 million (Q2 2018: EUR 17.4 million)

- HY1 2019 revenue decrease of 9% to EUR 217.3 million (HY1 2018: EUR 239.6 million)

- Normalised EBITDA in HY1 2019 of EUR 25.4 million from EUR 35.1 million in HY1 2018

- Normalised EBITDA margin in HY1 2019 of 11.7% from 14.6% in HY1 2018

- Normalised net profit of EUR 8.3 million in HY1 2019 (HY1 2018: EUR 15.8 million)

- New share buyback programme of max. EUR 10 million reflecting confidence in Kendrion's strategy and future

Joep van Beurden, Kendrion CEO:

"We have had a difficult first half of 2019, as the global automotive market continues to be challenging. Global car production declined by 6.7% compared with the first half of 2018, with weakness in all major markets, and especially China. Industrial markets weakened as well and purchasing managers' indexes around Europe are now pointing towards a contraction in industrial activity. This has had a significant impact on our revenue, which declined by 9% compared with HY1 2018. Automotive revenue decreased by 12% and Industrial by 4%.

The difficult trading environment inevitably puts our short-term results under pressure. We have simplified and streamlined the organisation, decreased our costs significantly and increased our focus. This enables us to cope with the current headwinds that we expect to continue in the second half of 2019.

We firmly believe in our longer-term prospects and continue to invest in our three focus areas: Automotive and specifically in products relevant to the development of Autonomous, Connected, Electric, Shared vehicles, the so called "ACES", permanent magnet brakes for robotics and in China. We see opportunities for healthy growth in all areas.

In Automotive, we are working on six "Lighthouse Projects", developing products such as a Sensor Cleaning Valve and Control System, AVAS Sound Systems and a Battery Cooling Valve and Control System. In robotics, the next phase of our China production line is on schedule, while in that same China facility, revenue grew by more than 20% compared with the first half of 2018, despite slowing economic growth.

We take a long-term view of the opportunities for both our Automotive and Industrial activities; these opportunities remain intact and we reiterate our long-term financial targets of ROIC of at least 20% and an EBITDA margin of more than 15% by 2023.

Despite the difficult market conditions and short-term economic uncertainty, we face the future with confidence. Today we announce our intention to buy back shares with an aggregate market value equivalent of up to EUR 10 million in order to reduce our issued share capital."

Progress on strategy

Having successfully simplified its organisation over the past three years, Kendrion has significantly improved its position in dealing with market cyclicality and volatility. The Company has built a robust organisation and benefits from a continued strong financial position.

As we are experiencing continued market-related headwinds, Kendrion will maintain its focus on further improving operational effectiveness and containing cost levels. At the same time, we will continue to invest in our three focus areas: Automotive, Brakes for robotics and China.

In Automotive, we are preparing to make maximum use of the opportunities created by the significant disruption that is upon us. As vehicles become ever more Autonomous, Connected, Electric, and Shared, the so-called "ACES", we are working on six Lighthouse Projects relevant to the ACES. These are currently focused on Autonomous, which includes developments in Sensor Cleaning Valve and Control System, Active Damping Actuators and positioning sensors for truck automation, and Electric - where we are working on a Battery Cooling Valve and Control System, AVAS Sound Systems, and a Clutch for a Mild Hybrid Drivetrain.

The investments for additional capacity in China for permanent magnet brakes for robotics are on track. In China, our pipeline shows significant growth for the coming years and we continue to invest in production equipment, in additional staff, and in training to accelerate local engineering know-how and capabilities.

Financial review

Revenue

Q2 2019

Revenue in the second quarter of 2019 came in at EUR 109.0 million, a decrease of 8% (9% at constant exchange rates) compared with the second quarter of 2018 (EUR 119.0 million). Revenue decreased by 3% (3% at constant exchange rates) in Industrial activities and by 11% (12% at constant exchange rates) in Automotive.

HY1 2019

Overall revenue for the first half of 2019 decreased by 9% (10% at constant exchange rates) to EUR 217.3 million (HY1 2018: EUR 239.6 million). Revenue for our Industrial activities in the first half of 2019 came in at EUR 82.1 million, a decrease of 4% (4% at constant exchange rates) compared with the same period last year (HY1 2018: EUR 85.6 million). In Automotive, revenue for the first half of 2019 amounted to EUR 135.2 million, a decrease of 12% (13% at constant exchange rates) compared with the same period last year (HY1 2018: EUR 154.0 million).

Results

Q2 2019

The normalised operating result before depreciation and amortisation (EBITDA) decreased by 27% to EUR 12.7 million (normalised Q2 2018: EUR 17.4 million). The lower profitability was the result of lower sales volumes in both Industrial and Automotive. Lower cost levels in Automotive as a result of last year's simplification measures only partly offset the lower volumes. In Industrial, the quarterly results were negatively impacted by lower production activities aimed at reducing levels of finished inventory. The EBITDA margin decreased from 14.6% in Q2 2018 to 11.7% in Q2 2019.

HY1 2019

Normalised EBITDA in HY1 2019 decreased by 28% to EUR 25.4 million (HY1 2018: EUR 35.1 million). The normalised EBITDA margin was 11.7% (HY1 2018: 14.6%).

Normalised EBITDA for the Industrial activities decreased to EUR 10.8 million from EUR 14.3 million in the same period last year.

The Automotive activities posted normalised EBITDA of EUR 14.6 million compared with EUR 20.8 million in HY1 2018.

The added value margin remained stable at 47.2%. Despite wage inflation, total staff costs in HY1 2019 decreased by 4% to EUR 63.0 million (HY1 2018: EUR 65.6 million) due to cost saving measures initiated in 2018 and adjustments of capacity to the lower volumes. Operating expenses were EUR 1.7 million higher than last year at EUR 14.2 million and depreciation charges increased by EUR 0.4 million to EUR 12.0 million following last year's investment programme.

Normalised net finance costs of EUR 1.2 million in the first six months of 2019 were lower than in the same period last year (HY1 2018: EUR 1.5 million) due to more favourable conditions in the new credit facility.

Normalised income tax expenses for HY1 2019 was EUR 2.8 million (HY1 2018: EUR 5.0 million). The normalised effective tax rate in the first six months of 2019 was 25.6% (HY1 2018: 23.9%).

Normalised net profit in HY1 2019 was EUR 8.3 million (HY1 2018: EUR 15.8 million). Normalised earnings per share amounted to EUR 0.62 (HY1 2018: EUR 1.18). Basic reported earnings per share amounted to EUR 0.66 (HY1 2018: EUR 0.87).

Financial position

The net debt position was EUR 96.2 million at the end of the second quarter, which is a EUR 8.6 million increase compared with the end of Q1. The net debt increase was partly due to the cash dividend payment of EUR 8.1 million and the share buyback programme that resulted in a cash outflow of EUR 2.0 million in Q2. The net debt position at the end of the second quarter included IFRS 16 liabilities in an amount of EUR 14.8 million.

Normalised free cash flow came in at EUR 2.7 million negative in the first half year (HY1 2018: EUR 4.3 million). Free cash flow in Q2 was positive at EUR 3.3 million. Kendrion's efforts to reduce inventory levels, which had increased since the second half of 2018, started to bear fruit with a EUR 3.5 million reduction in the second quarter. Cash flow and reducing working capital will remain a focus point for the remainder of the year.

Capital expenditure totalled EUR 10.2 million in the first half of 2019, below the depreciation level of EUR 12.0 million. Investments for the full year 2019 are anticipated to be in line with the depreciation level as a result of strict capex control with respect to non-project related investments.

Kendrion's financial position is strong; the solvency ratio stood at 46.9% at the end of June 2019.

Number of employees

The number of employees (FTEs) at the end of the second quarter was 2,473, including 121 temporary employees (Q1 2019: 2,450 employees, including 94 temporary employees).

Operational performance

Industrial activities

The Industrial activities consist of Industrial Magnetic Systems, Industrial Control Systems and Industrial Drive Systems.

Industrial activities, which accounted for 38% of Kendrion's revenue, experienced a decrease in revenue in the second quarter. The sector came seemed to be under increased pressure as the German machine building market weakened. Revenue for the first half of 2019 came in at EUR 82.1 million, a decrease of 4% compared with the same period last year (HY1 2018: EUR 85.6 million).

ICS experienced a setback in the second quarter, which was largely caused by a postponed start of two new projects in their flow control activities. ICS saw its profitability decline due to the lower revenue, while its profitability remained at a good level in absolute terms. Although revenue decreases in IMS and IDS were more modest, both these business units also experienced a decrease in profitability. IDS profitability was affected by significant growth investments both in Germany and China. Both IMS and IDS substantially reduced production to decrease inventory levels.

Industrial's normalised EBITDA margin for HY1 2019 was 13.1%, compared with 16.7% in HY1 2018.

ICS has almost finalised the insourcing of valves for a whole range of fluid control products from a third-party vendor in Italy, which will reduce third-party dependency and is anticipated to generate significant annual savings starting in 2020.

Automotive activities

Up to and including 2018, the Automotive activities consisted of two business units: Passenger Cars and Commercial Vehicles. As of 1 January 2019, both business units and the central corporate function have been combined into a centralised functional Automotive organisation.

Automotive activities, which accounted for 62% of Kendrion's revenue, were significantly impacted by the continued weak trading environment because of declining car sales around the world. This affected almost all players in the global automotive supply chain, including our leading major automotive customers. Revenue for the first half of 2019 came in at EUR 135.2 million, a decrease of 12% compared with the same period last year (HY1 2018: 154.0 million).

The normalised EBITDA margin was 10.8%, down from 13.5% in HY1 2018.

Automotive staff costs decreased by 8% due to restructuring measures initiated last year and adjustments of capacity to the lower volumes. Total costs including other operating expenses and depreciation charges decreased by 4% compared with last year.

The transition to the new Automotive organisation is well on track. The manufacturing plants managed by the COO have initiated various efficiency improvement programmes. The Automotive commercial organisation is generating traction as we received an increasing number of RFQs in our strategic focus areas. New project wins include a park lock application in China, a new active damping project in Europe and hydraulic solenoids for agricultural machines in the U.S.

Alternative Performance Measures (APM) adjustments to EBIT(D)A and net profit

In Automotive, an amount of EUR 1.6 million (EUR 1.2 million after tax) related to an out-of-court settlement of an alleged breach of contract claim from a supplier has been normalised in the results and is adjusted in EBITDA. The tax provision related to the German tax audits was increased by EUR 0.3 million following the closing meeting with the tax authorities in Northern Germany, which is adjusted in net profit. A positive currency result of EUR 2.0 million related to the release of the cumulative currency translation reserve, following the liquidation of legal entities in China and Switzerland, was normalised in the result and adjusted in net profit. For a full reconciliation see page 12.

Outlook

The outlook for the automotive industry continues to be weak. The industrial markets showed modest softening in the first few months of the year and came under more pressure as the year advanced. Leading manufacturing indicators now indicate a contraction in activity.

We have streamlined the organisation, brought cost levels down and have a strong financial position. This enables us to cope with the current headwinds that we expect to continue in the second half of 2019.

For the medium and long term, we remain positive about our business fundamentals, with our main objective being to deliver sustainable profitable growth. We reiterate our medium-term targets of ROIC of at least 20% and an EBITDA margin of more than 15% by 2023.

Post-balance sheet events

Kendrion has decided to launch a new share buyback programme, repurchasing up to an amount of EUR 10 million or 625,000 ordinary shares reflecting confidence in its strategy and future. The programme will start on 13 August 2019 and end on 31 December 2019 at the latest. The shares will be cancelled upon purchase.

The share buyback programme initiated on 13 May 2019 to neutralise the effect of the stock dividend was completed on 17 July 2019. The new buyback programme is in addition to the Company's stated policy to pay an annual dividend to shareholders in the range of 35% to 50% of the annual profit.

Audio webcast interim results 2019

Kendrion CEO Joep van Beurden and CFO Jeroen Hemmen will present the interim results on Tuesday, 13 August 2019 at 1:00 p.m. A live audio webcast will be available on www.kendrion.com with playback functionalities.

Profile of Kendrion N.V.

Kendrion develops, manufactures and markets high-quality electromagnetic systems and components for industrial and automotive applications. For over a century, we have been engineering precision parts for the world's leading innovators in passenger cars, commercial vehicles and industrial applications. As a leading technology pioneer, Kendrion invents, designs and manufactures complex components and customised systems as well as local solutions on demand.

We are committed to the engineering challenges of tomorrow, and taking responsibility for how we source, manufacture and conduct business is embedded into our culture of innovation. Rooted in Germany, headquartered in the Netherlands and listed on the Amsterdam stock exchange, Kendrion's expertise extends across Europe to the Americas and Asia. Created with passion and engineered with precision. Kendrion – we magnetise the world.

Declaration of the Board

The Executive Board declares that, with due regard for what has been described in this report, to its knowledge, (i) the semi-annual financial statements give a true and fair view of the assets, liabilities, financial position and profits of Kendrion N.V. and the companies jointly included in the consolidation, and (ii) the semi-annual report gives a true and fair overview of the information required pursuant to Article 5 25d sub 8 and 9 of the Netherlands Financial Supervision Act.

Amsterdam, 13 August 2019

The Executive Board

For more information, please contact:

Kendrion N.V.

Mr Joep van Beurden

Chief Executive Officer

Tel: +31 85 073 1504

Email: IR@kendrion.com

Website: www.kendrion.com

Annexes

1. Financial calendar 2019 – 2020

2. Semi-annual financial statements 2019

1. Consolidated statement of comprehensive income

2. Consolidated statement of financial position

3. Consolidated statement of cash flows

4. Consolidated statement of changes in equity

5. Reconciliation of normalised to reported 2019 figures

6. Risks and risk management

7. Notes to the interim financial statements

Press release: HALF YEAR RESULTS 2019

Presentation:ANALYSTS'S MEETING